Indicator Overview

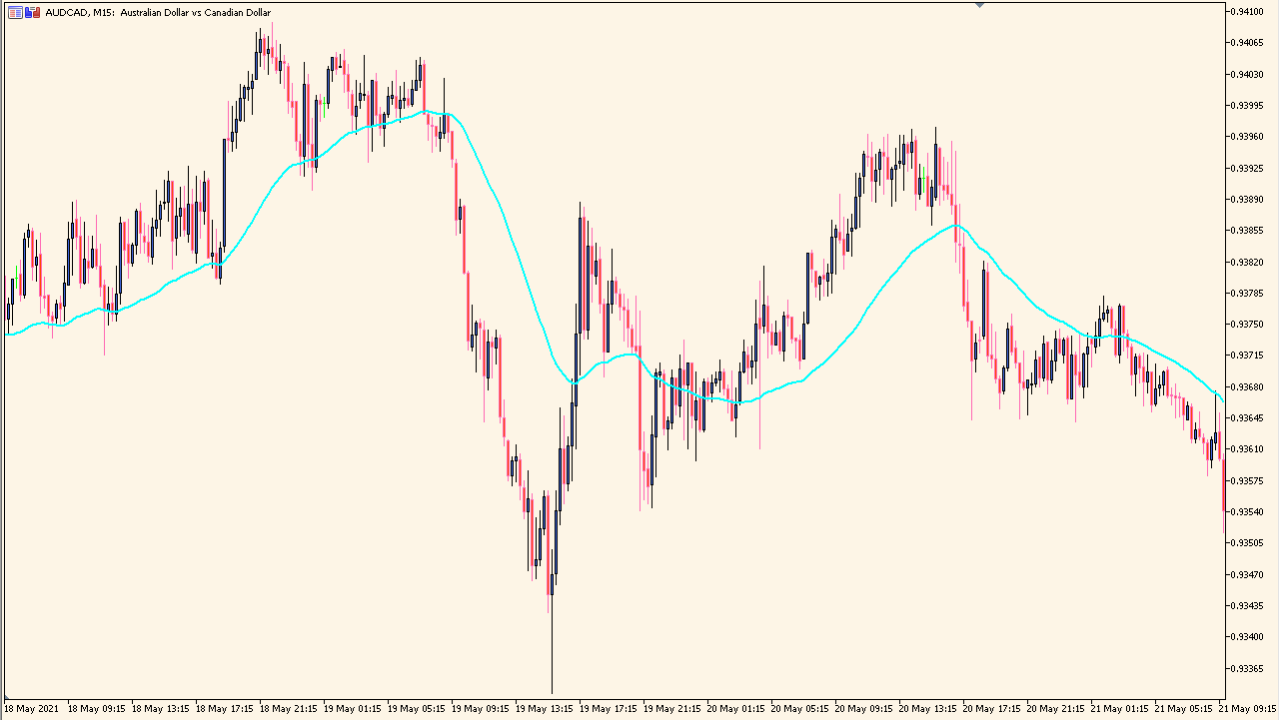

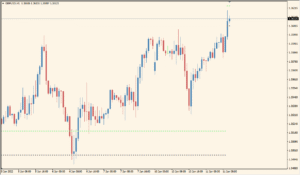

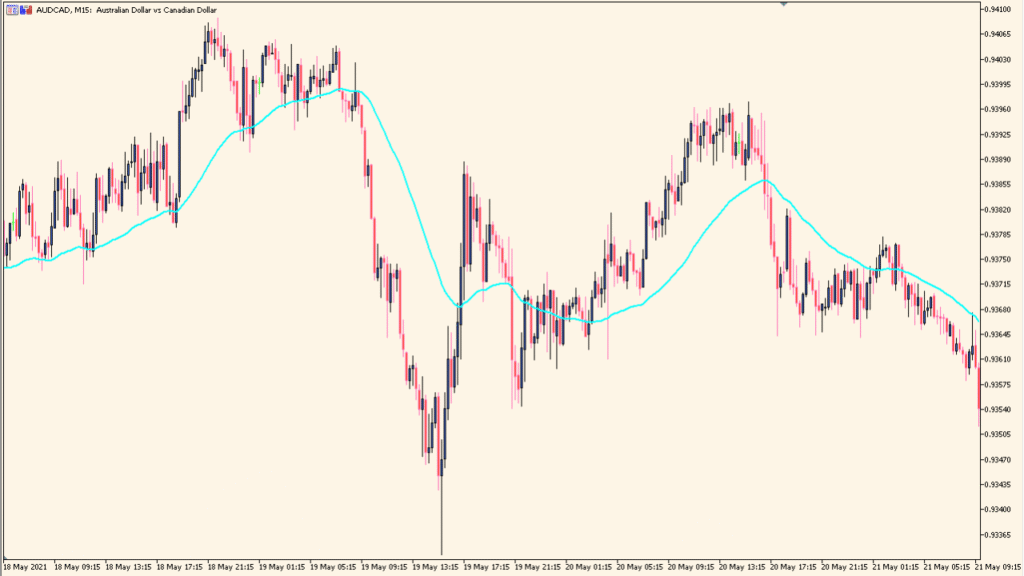

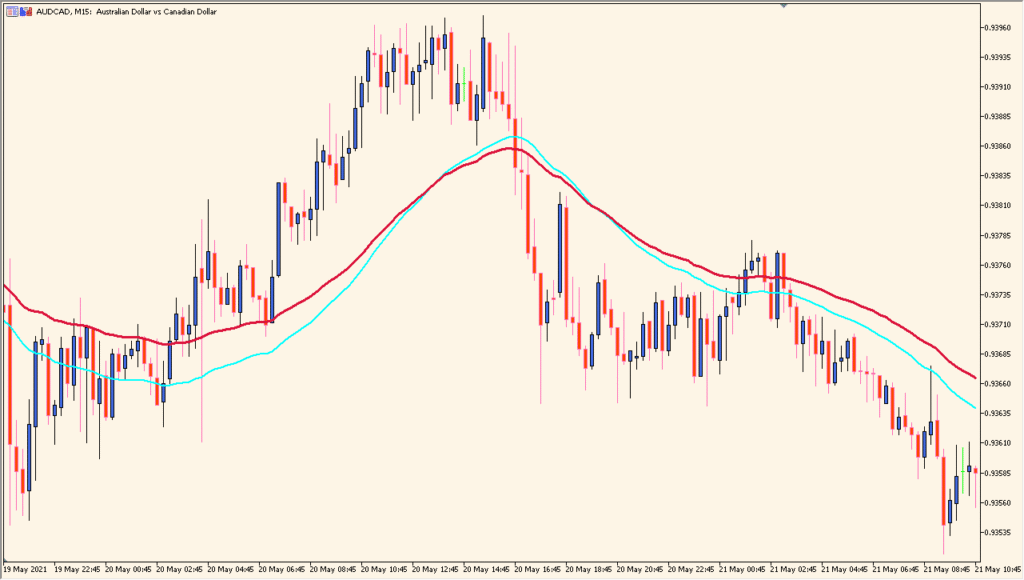

The 3rdGenMA indicator for MT4 is a flexible and responsive moving average tool that lets you fine-tune how price data is smoothed. It includes control over the period, sampling frequency, method, and applied price, making it ideal for traders who want a tailored approach to trend analysis.

Unlike standard moving averages, this version provides extra control through the “sampling period” and use of advanced smoothing formulas. It’s designed to reduce lag while maintaining trend clarity.

How to Use It in Practice

You can apply 3rdGenMA to any chart and timeframe to:

- Track trend direction more smoothly than with standard MAs.

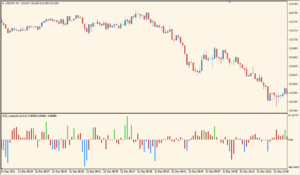

- Filter entries by combining with RSI, MACD, or price action signals.

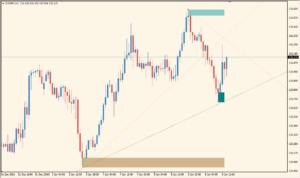

- Adjust sensitivity by modifying sampling and method settings.

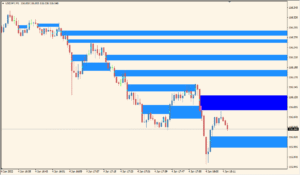

- Use it as part of algorithmic strategies requiring adaptive smoothing.

It works best in trending markets and higher timeframes where smoothness matters for strategy decisions.

Parameter Explanations

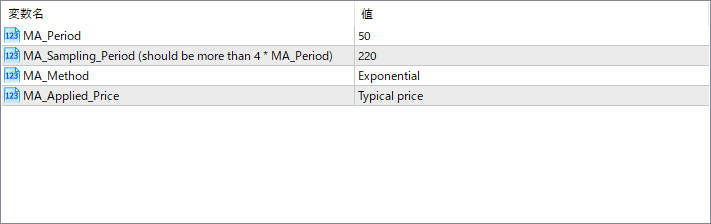

MA_Period

Controls the length of the moving average. A higher value results in a smoother line and slower reaction to price changes.

MA_Sampling_Period

Defines how many price points are used internally for advanced smoothing. This can help reduce noise further than traditional moving averages.

MA_Method

Selects the moving average type: options include Simple, Exponential, Smoothed, or Linear Weighted. Each has a different response to price movement.

MA_Applied_Price

Specifies which price is used in the calculation — options include close, open, high, low, or typical price. This affects how the MA reacts to market behavior.