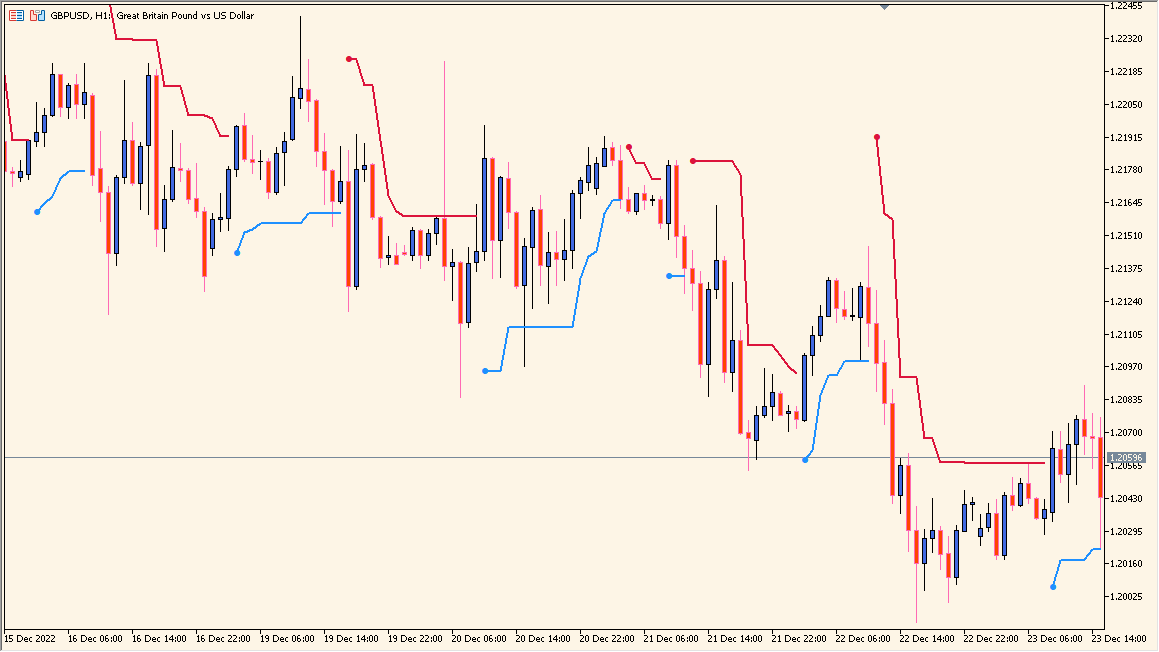

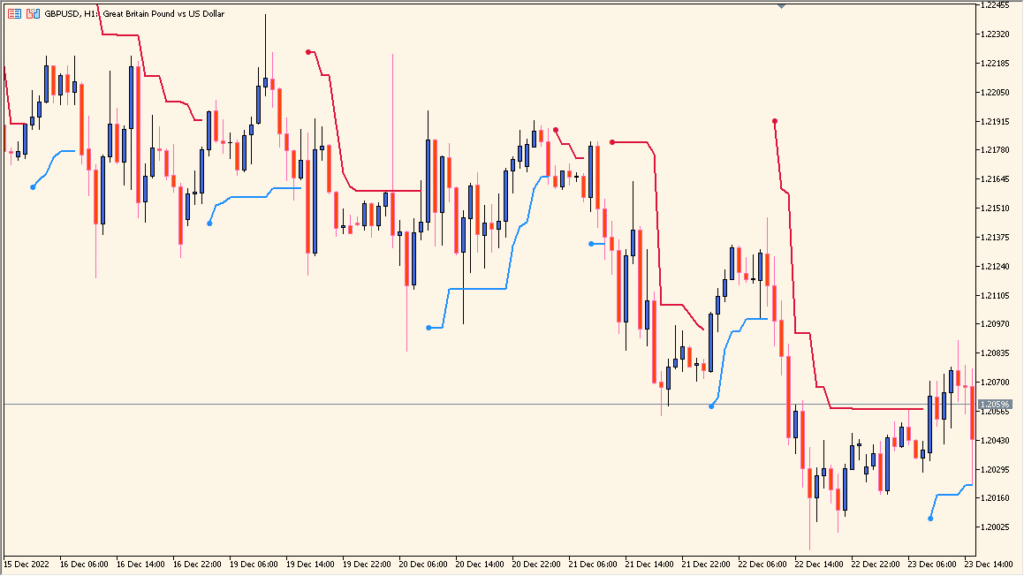

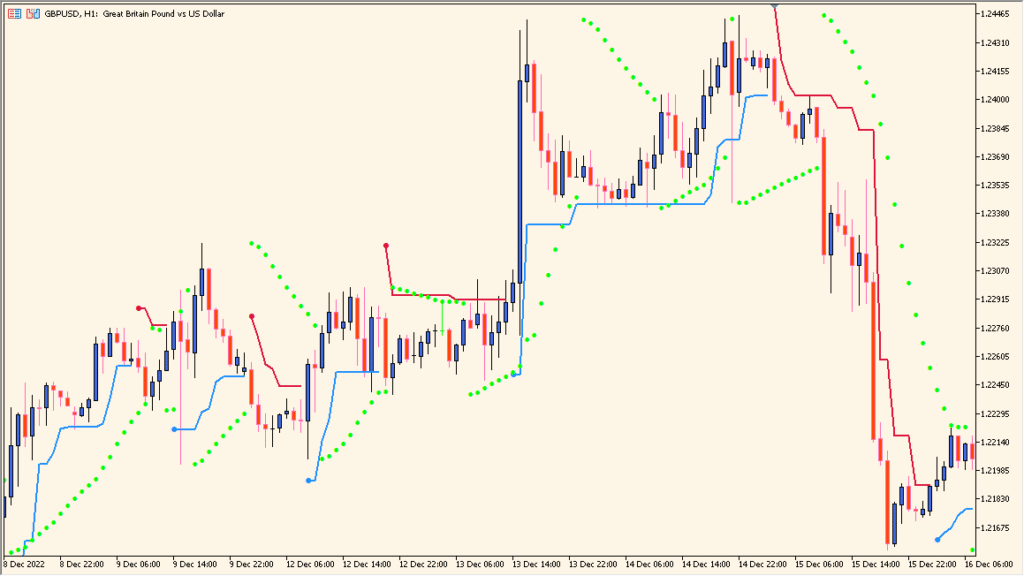

Overview of the ATR Trend Envelopes Indicator

The ATR Trend Envelopes indicator for MT4 draws upper and lower envelope lines based on the Average True Range (ATR). These envelopes adapt dynamically to market volatility, expanding during volatile periods and contracting when the market is quiet. It helps traders identify the current trend direction and potential reversals through price interaction with these envelopes.

When price stays above the lower envelope, it indicates a bullish environment. Conversely, when price remains below the upper envelope, it signals a bearish phase. The indicator acts as a volatility-adjusted trend filter, combining the logic of moving averages with the flexibility of ATR-based ranges.

How to Use It in Practice

In live trading, you can use the ATR Trend Envelopes indicator to:

- Identify the current market trend based on the envelope direction.

- Spot potential entry points when price breaks and closes beyond an envelope line.

- Set dynamic stop-loss or trailing stop levels using the envelope boundaries.

- Filter false signals during sideways markets by observing the contraction of the envelopes.

This indicator works well in trend-following strategies and can be combined with momentum or volume-based tools for confirmation.

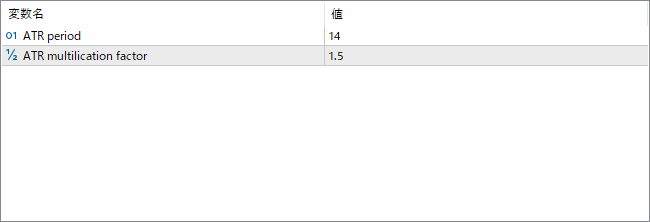

Parameter Explanations

ATR period

Defines how many candles are used to calculate the Average True Range. A shorter period makes the envelopes more sensitive, while a longer one smooths the lines.

ATR multiplication factor

Specifies how much the ATR value is multiplied to determine the distance between the price and the envelope lines. Increasing this factor widens the envelopes, while reducing it makes them tighter.