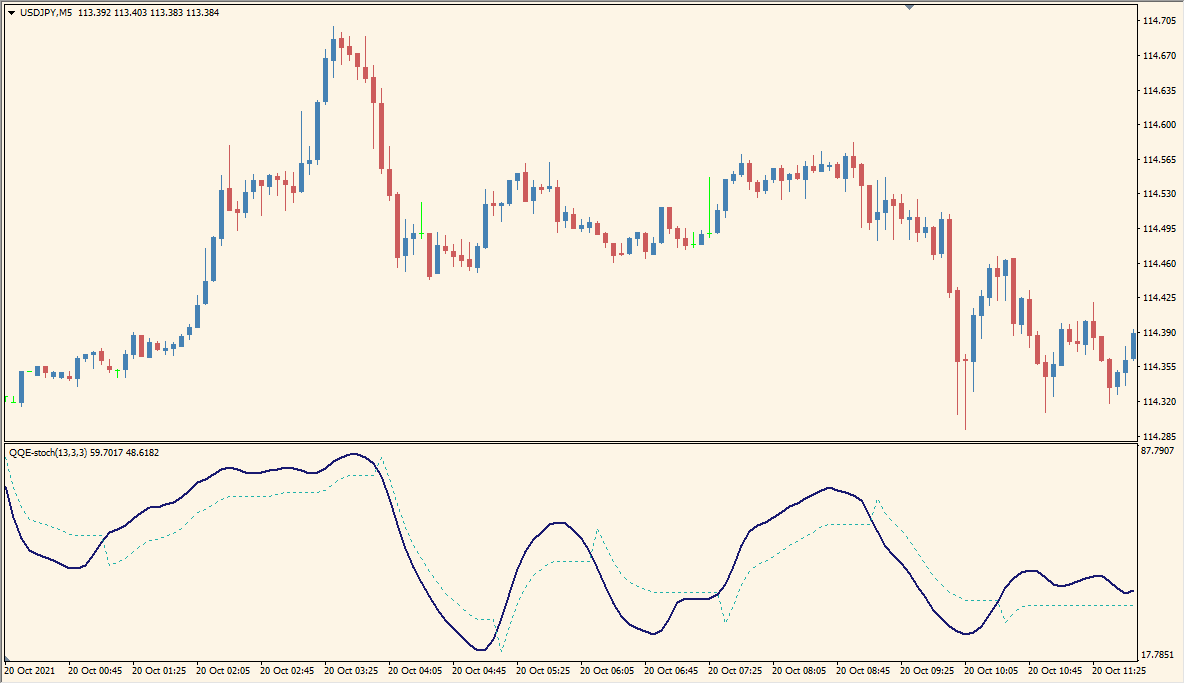

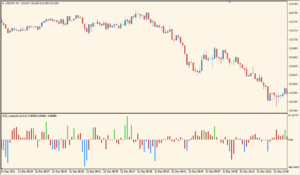

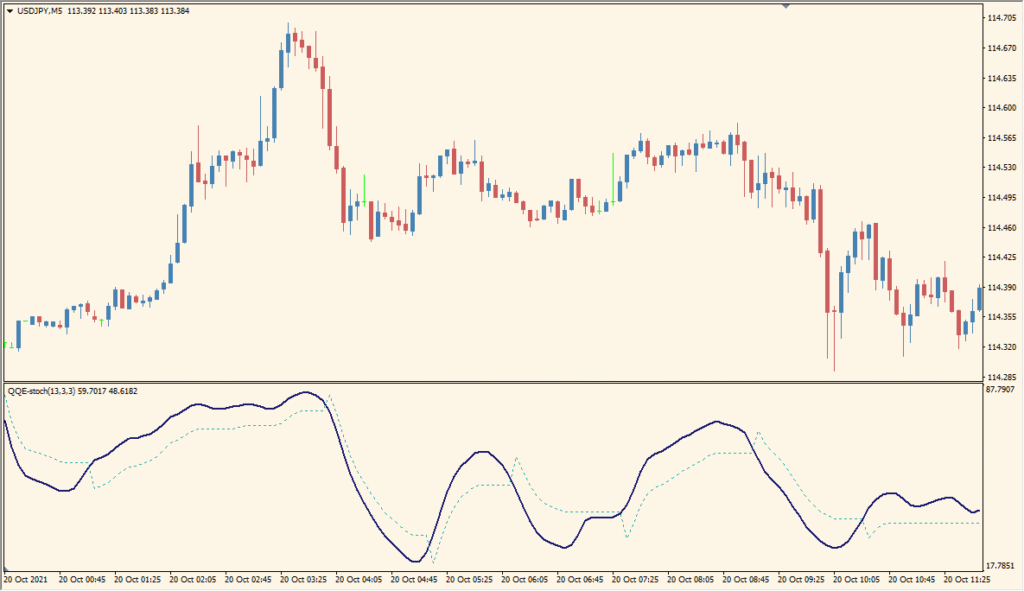

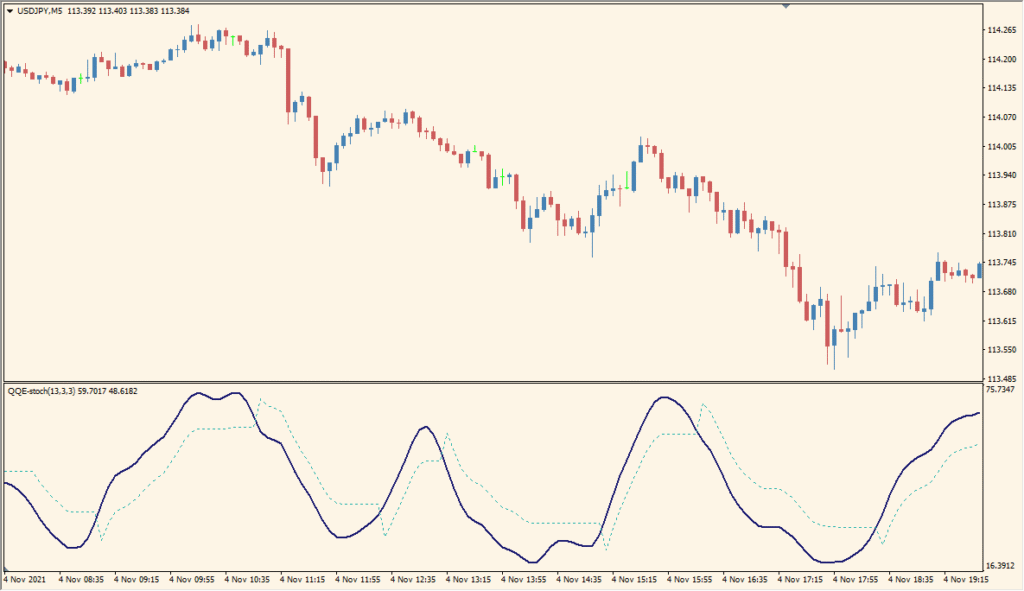

Overview of the QQE-stoch Indicator

The QQE-stoch indicator is a hybrid tool that combines elements of the Quantitative Qualitative Estimation (QQE) and the Stochastic Oscillator. It is designed to provide a smoothed momentum reading while retaining the oversold and overbought detection capabilities of a standard stochastic. The result is a cleaner visual that helps filter noise while still offering early entry signals.

This indicator is often used to identify potential trend reversals and confirm momentum strength. It helps traders avoid choppy market phases and focus on cleaner setups by smoothing out the traditional stochastic values.

How to Use It in Practice

In trading, QQE-stoch can be applied to:

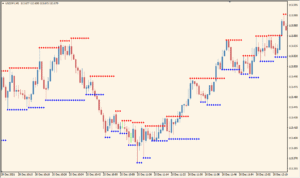

- Detect overbought and oversold market conditions using a smoothed stochastic approach.

- Generate buy/sell signals when the %K line crosses above or below the %D line, especially near the extreme levels.

- Confirm trend momentum in combination with other indicators such as moving averages or RSI.

- Avoid false signals in sideways markets due to the additional smoothing layer.

This makes QQE-stoch especially useful for swing traders and scalpers who want a responsive yet stable oscillator to guide entries and exits.

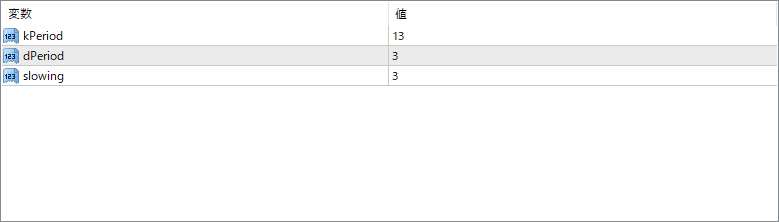

Parameter Explanations

kPeriod

This defines the period used to calculate the %K line of the stochastic component, which is the fast-moving part of the oscillator.

dPeriod

Sets the period for the %D line, which is the slower moving average of the %K line, used for signal line crossovers.

slowing

Applies additional smoothing to the %K line before calculating the %D, making the signals more stable and reducing noise.