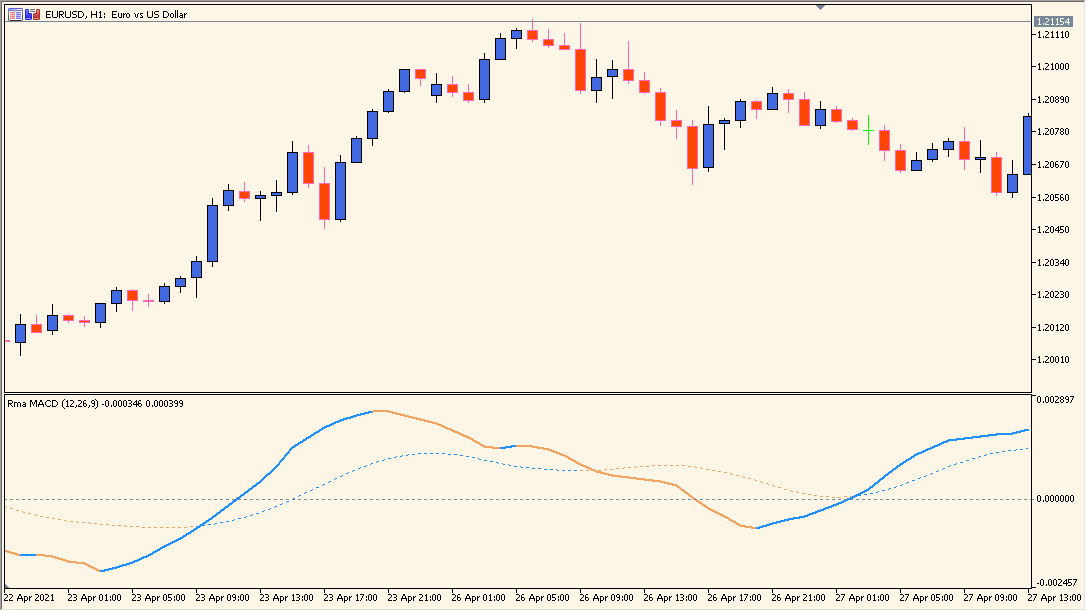

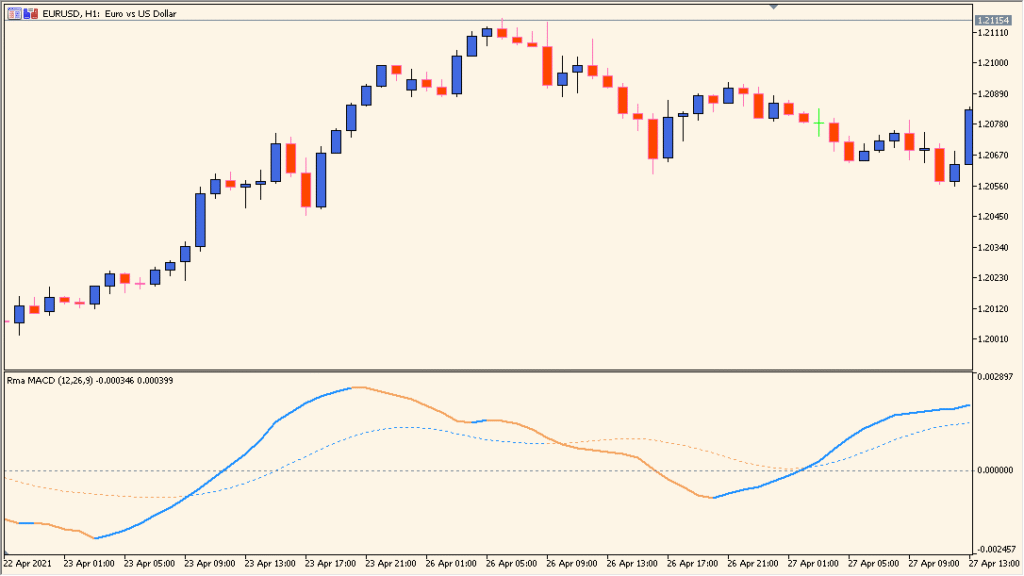

Overview of the RMA MACD Indicator

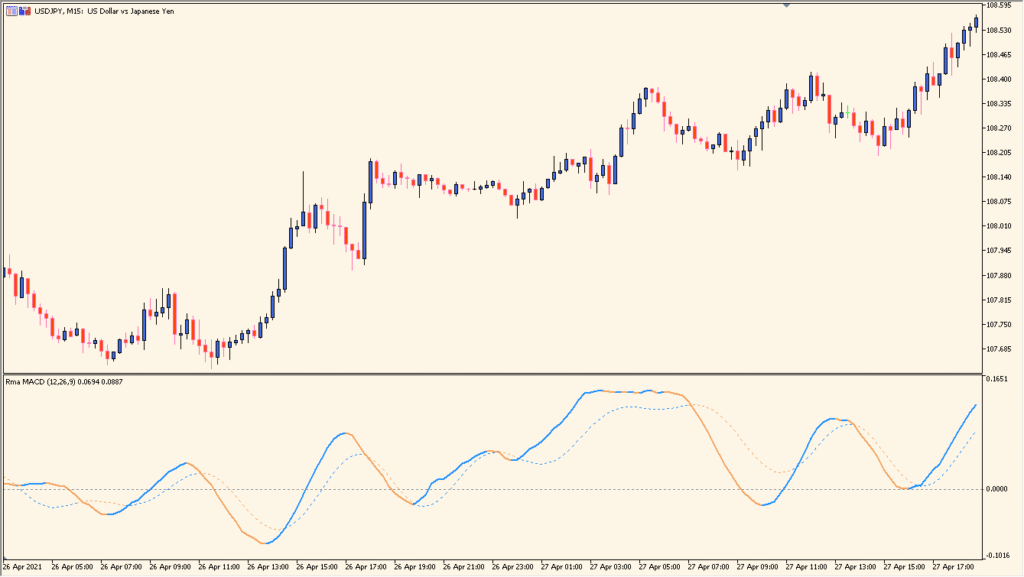

The RMA MACD indicator is a variation of the classic MACD (Moving Average Convergence Divergence) designed to smooth out noise using RMA (Running Moving Average) instead of EMA. It aims to provide more stable trend and momentum signals while retaining the familiar MACD structure with the main line, signal line, and histogram.

This version helps filter out minor fluctuations and makes it easier to focus on more meaningful market movements, particularly in volatile or choppy environments.

How to Use It in Practice

In trading, the RMA MACD is used similarly to the traditional MACD but may appeal more to traders looking for smoother signals. You can:

- Look for crossovers between the MACD line and signal line as entry/exit signals.

- Use the histogram to judge momentum strength and potential reversals.

- Spot divergences between price and MACD for early warnings of trend shifts.

- Apply it to various timeframes depending on your trading style (scalping, swing, etc.).

Thanks to its RMA-based smoothing, signals may be slightly delayed compared to the traditional MACD but are often cleaner and less prone to whipsaws.

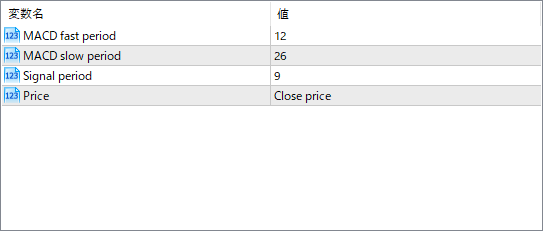

Parameter Explanations

MACD fast period

Sets the period for the fast RMA. A shorter value reacts more quickly to price changes.

MACD slow period

Defines the period for the slow RMA. A longer period smooths the indicator further.

Signal period

Controls how many periods are used to calculate the signal line (usually a moving average of the MACD line).

Price

Specifies which price source the MACD is based on. Common options are Close, Open, High, or Low.