Overview of the ASO Indicator

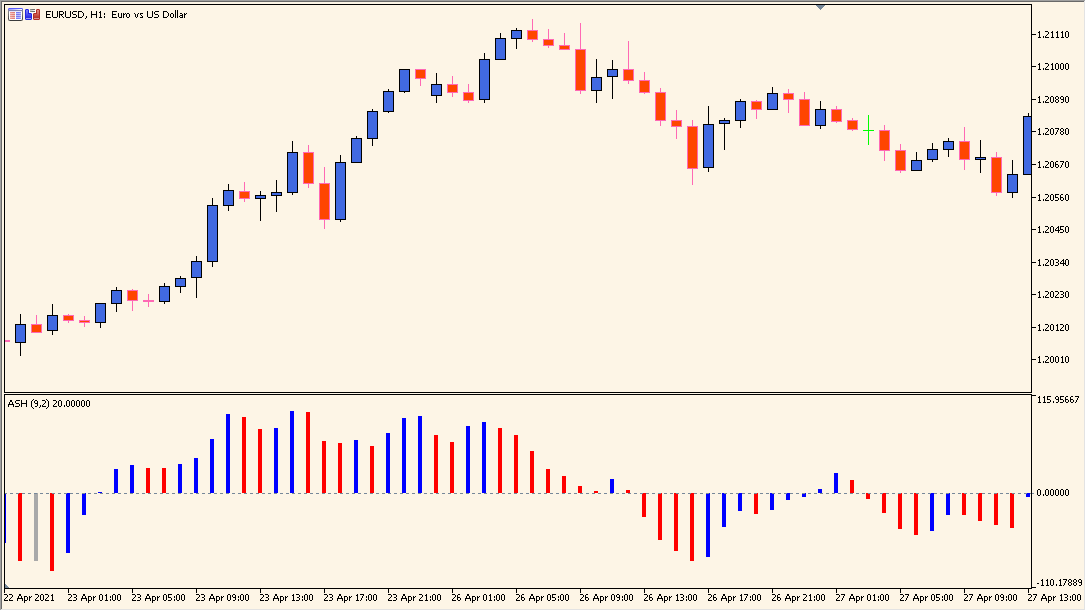

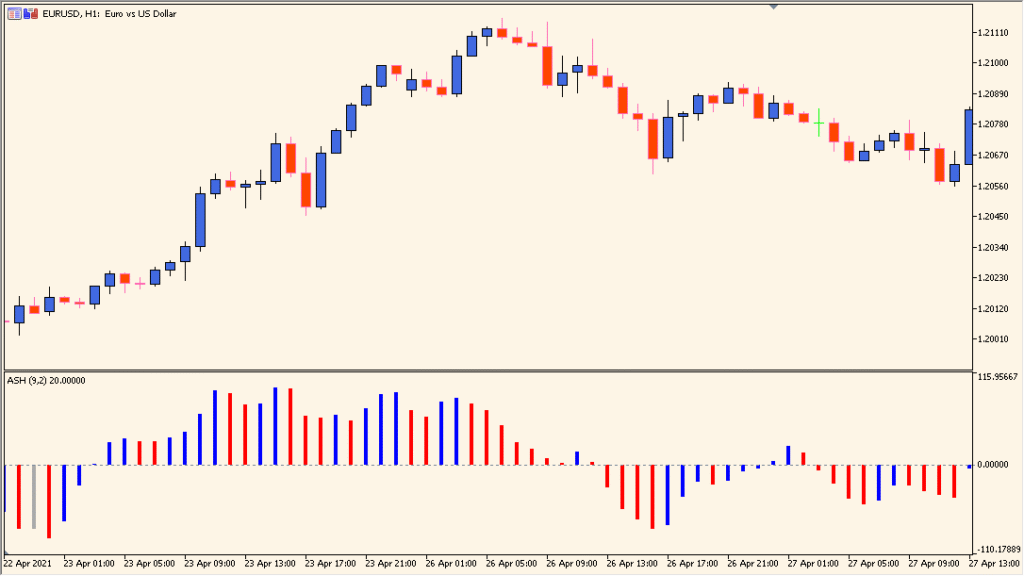

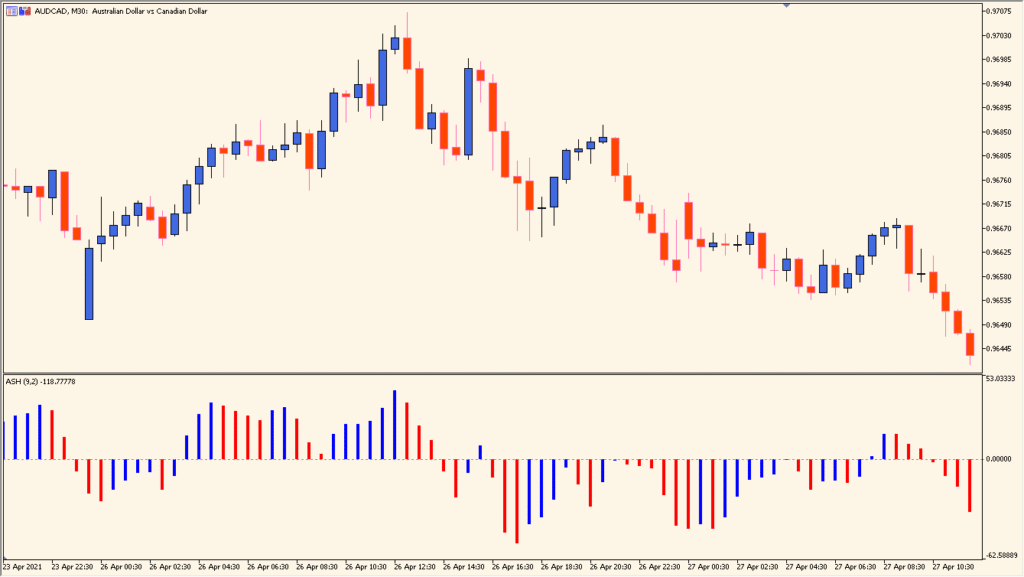

The ASO (Adaptive Smoothed Oscillator) indicator for MT4 is a momentum tool that combines classic indicators like RSI with smoothing algorithms to reduce noise. It displays momentum as a color-changing histogram, making it easier to spot trend shifts and overbought/oversold conditions at a glance.

It’s useful in both trending and ranging markets, with histogram bars changing from blue to red (and vice versa) to reflect a change in direction or strength. The adaptive smoothing approach helps filter out short-term fluctuations.

How to Use It in Practice

You can use the ASO indicator to:

- Confirm trend direction or fading momentum.

- Spot early reversal signals when the histogram changes color.

- Identify divergence between price and oscillator to anticipate potential breakouts or pullbacks.

- Combine with support/resistance or moving averages to improve entry precision.

It works well across different timeframes and trading styles, especially when paired with other filters.

Parameter Explanations

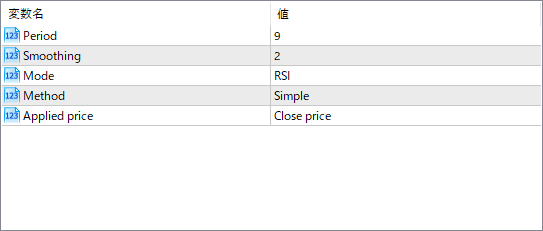

Period

Sets the number of bars used for calculating the base momentum value. Shorter values make it more reactive, while longer values smooth it out.

Smoothing

Defines how much smoothing is applied to the momentum calculation. Higher values create a more stable histogram but may lag slightly.

Mode

Selects the momentum type used as input. “RSI” applies the Relative Strength Index. Other modes might be available in the code.

Method

Specifies the type of moving average used for smoothing — for example, Simple or Exponential.

Applied price

Determines which price feed is used in the calculation, such as close, open, high, or low.