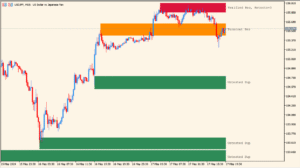

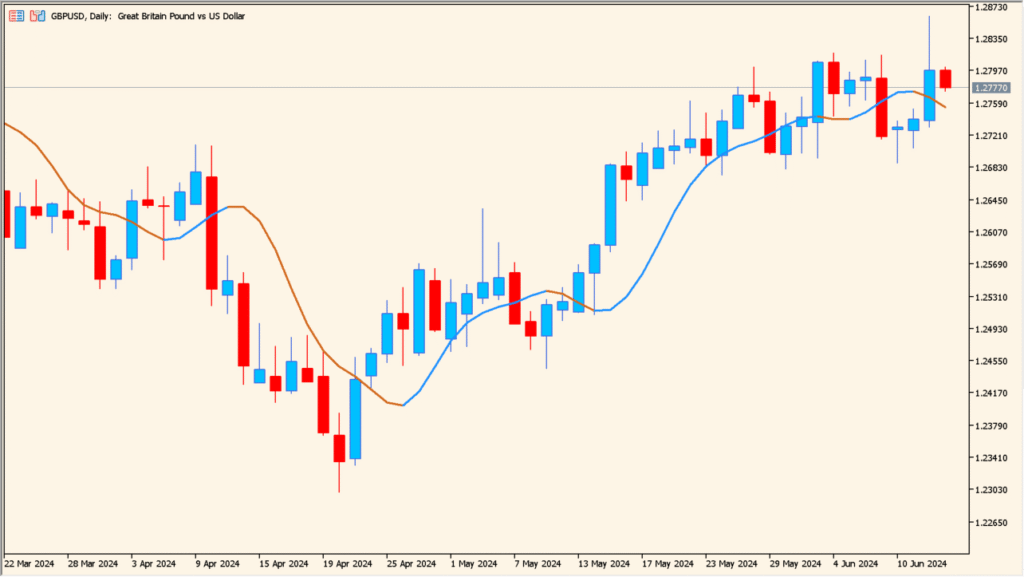

Indicator Overview

The Bezier indicator applies Bezier curve smoothing to price data to create a clean and flowing representation of market movement. By reducing minor noise while keeping the overall structure intact, it helps traders see direction changes and trend continuity more clearly than with raw candles alone.

Unlike standard moving averages, the curve reacts smoothly and visually, making it easier to judge momentum shifts and pauses without overreacting to short-term volatility.

How to Use It in Practice

In real trading scenarios, the Bezier indicator can be used to:

- Identify the current market direction with a smooth visual guide.

- Spot potential trend changes when the curve bends or changes slope.

- Filter out minor pullbacks and focus on the dominant price flow.

- Combine with price action or other indicators for confirmation.

It works well for both trend-following and timing pullbacks, especially on lower timeframes where noise is more visible.

Parameter Explanations

Smoothing period

Controls how many bars are used to build the Bezier curve. Higher values create a smoother line that reacts slower, while lower values make the curve follow price more closely.

Sensitivity ratio (from 0 to 1)

Adjusts how responsive the curve is to price changes. Values closer to 1 make the curve more sensitive, while lower values emphasize stability.

Applied price

Defines which price data is used for calculation, such as close price or weighted close. This affects how the curve reflects candle structure.

Horizontal shift of the indicator in bars

Moves the indicator forward or backward on the chart for visual alignment or analysis purposes.

Vertical shift of the indicator in points

Shifts the curve up or down by a fixed number of points without changing its shape.