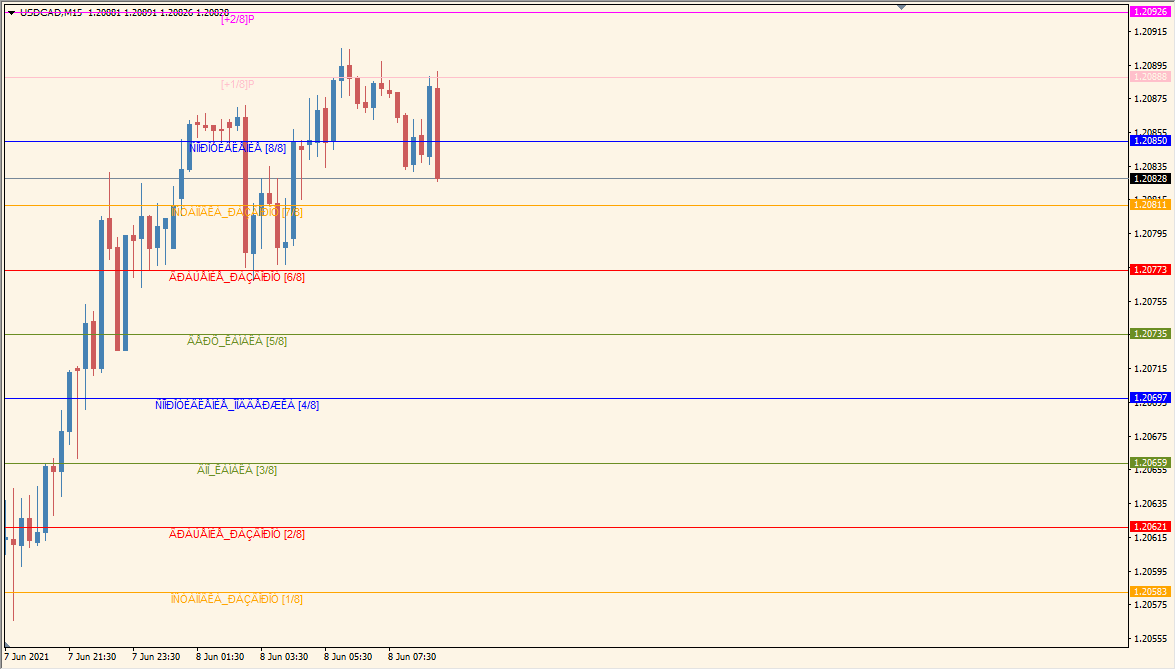

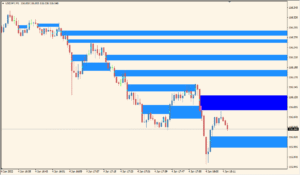

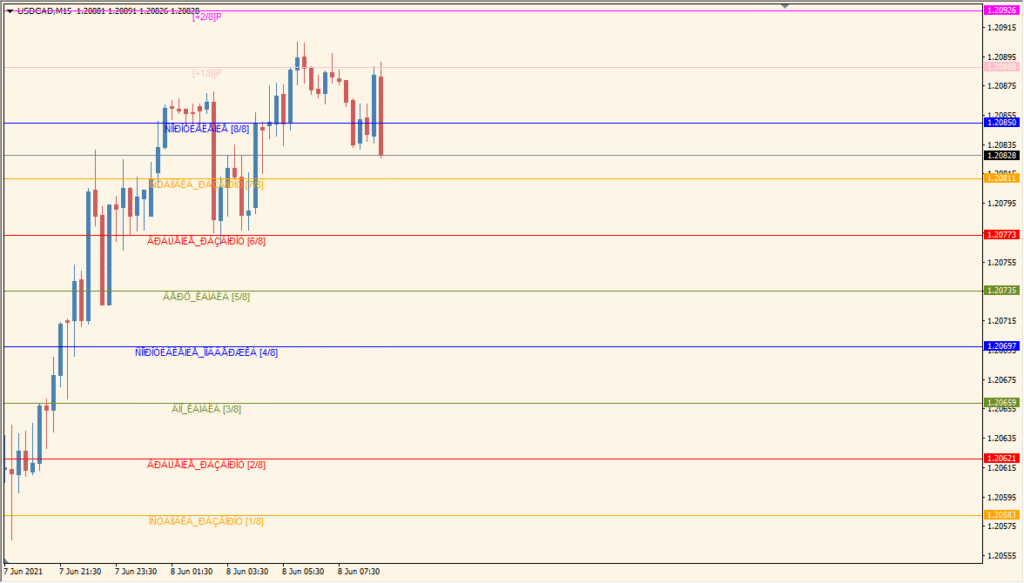

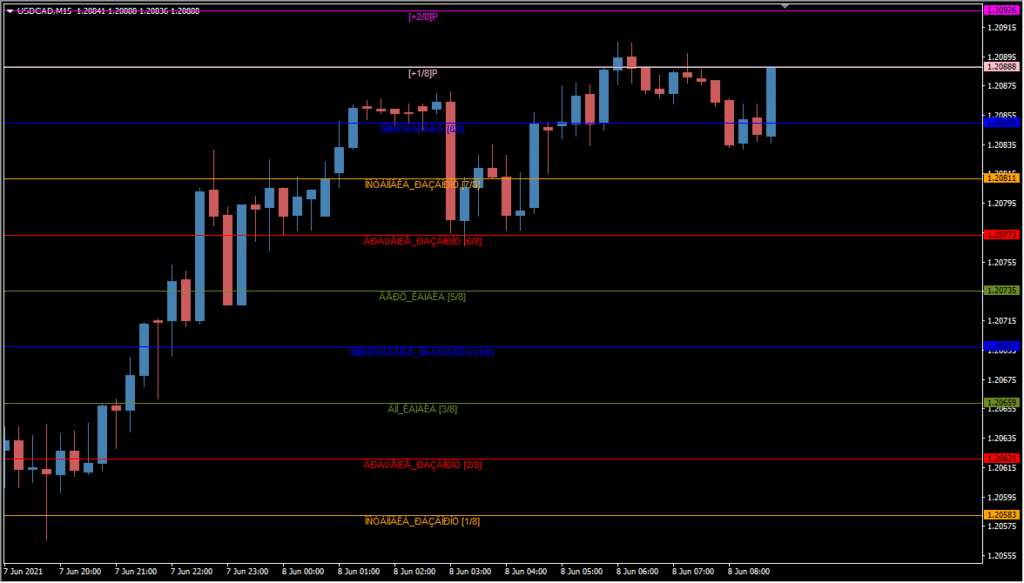

Overview of the Murrey Levels System

The Murrey Levels System indicator for MT4 is designed to plot key horizontal price levels based on Murrey Math principles. These levels divide the price range into 8 segments (plus overshoot zones), providing a structured framework for identifying potential support and resistance. It helps traders anticipate where price is likely to stall, reverse, or break out.

Each level has a unique significance. For example, [4/8] is considered a major support/resistance level, [0/8] and [8/8] are strong reversal points, and [2/8] and [6/8] often act as secondary support/resistance zones. This system can complement trend-following or range-trading strategies.

How to Use It in Practice

In real trading, the Murrey Levels System can be used to:

- Identify strong areas of support and resistance based on Murrey Math.

- Plan entry or exit points around the [4/8], [8/8], or [0/8] levels.

- Use the structure for breakout or reversal trades.

- Combine with oscillators or price action confirmation for more reliable setups.

This tool is especially helpful in markets with clear range-bound or oscillating behavior, and also aids in visualizing price positioning within broader cycles.

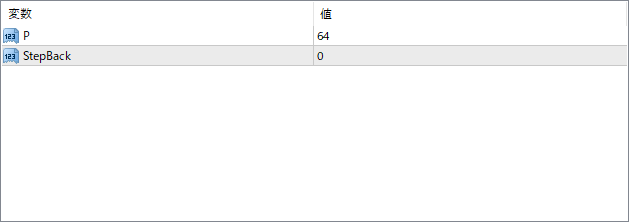

Parameter Explanations

StepBack

Defines how many bars back to calculate the Murrey range from. Increasing this will shift the calculated levels to an earlier part of the chart, which may help compare current price action with past levels.

Period

Specifies the number of bars to consider in defining the Murrey Math range. This affects the scaling and spacing of the horizontal levels. Shorter periods result in tighter levels, suitable for intraday trading, while longer periods give broader zones.