Indicator Overview

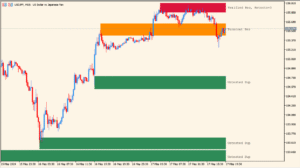

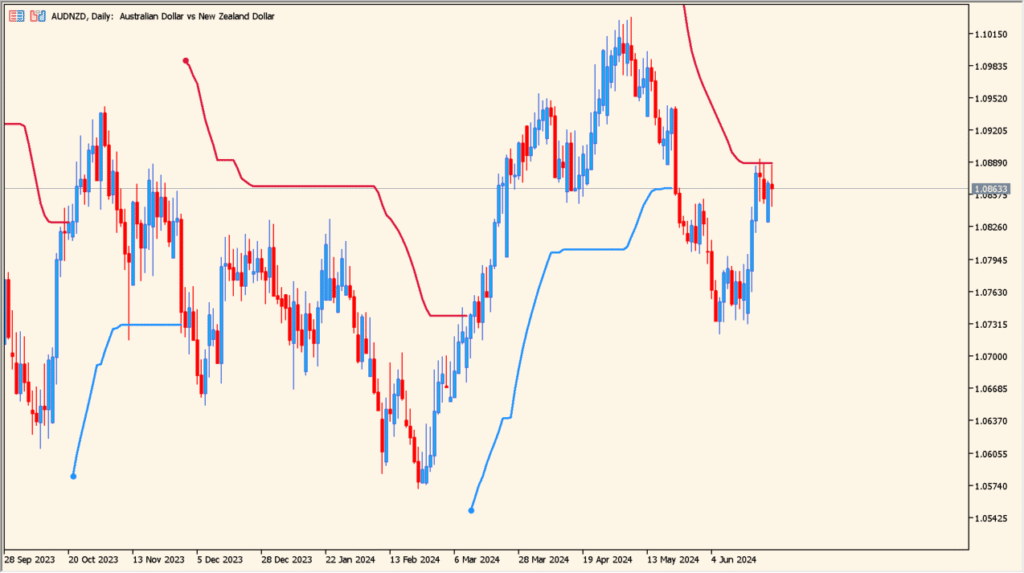

Smooth ATR Trend envelopes of averages is a trend-following indicator that uses ATR (Average True Range) to build adaptive envelopes around a smoothed average. Instead of reacting to every small price movement, it focuses on the broader price flow by combining volatility and smoothing.

The result is a clean trailing line that stays flat during consolidation and steps forward when the trend gains strength. This makes it useful for identifying trend direction, continuation, and potential stop or bias levels.

How to Use It in Practice

In real trading, this indicator is mainly used as a trend filter and management tool:

- Use the line position relative to price to confirm bullish or bearish trend bias.

- Stay with the trend while price remains on the same side of the envelope.

- Watch for changes in slope or flat sections as signs of consolidation or weakening momentum.

- Combine it with entry signals from other indicators to avoid trading against the main trend.

Because it reacts slowly and smoothly, it works well for swing trading and trend-following strategies rather than scalping.

Parameters

ATR period

Defines how many bars are used to calculate ATR. A longer period produces smoother volatility estimates, while a shorter one reacts faster to recent price changes.

ATR multiplication factor

Controls how far the envelope is placed from the average. Higher values create wider bands and fewer adjustments, lower values keep the line closer to price.

Smoothing period (<=1 for no smoothing)

Sets the amount of smoothing applied to the average. Higher values reduce noise, while values close to 1 keep the line more responsive.

Smoothing method

Selects the type of moving average used for smoothing, such as simple or other available methods. This affects how quickly the line adapts to trend changes.