Overview of the Standard Deviation Channels x3 Cloud Indicator

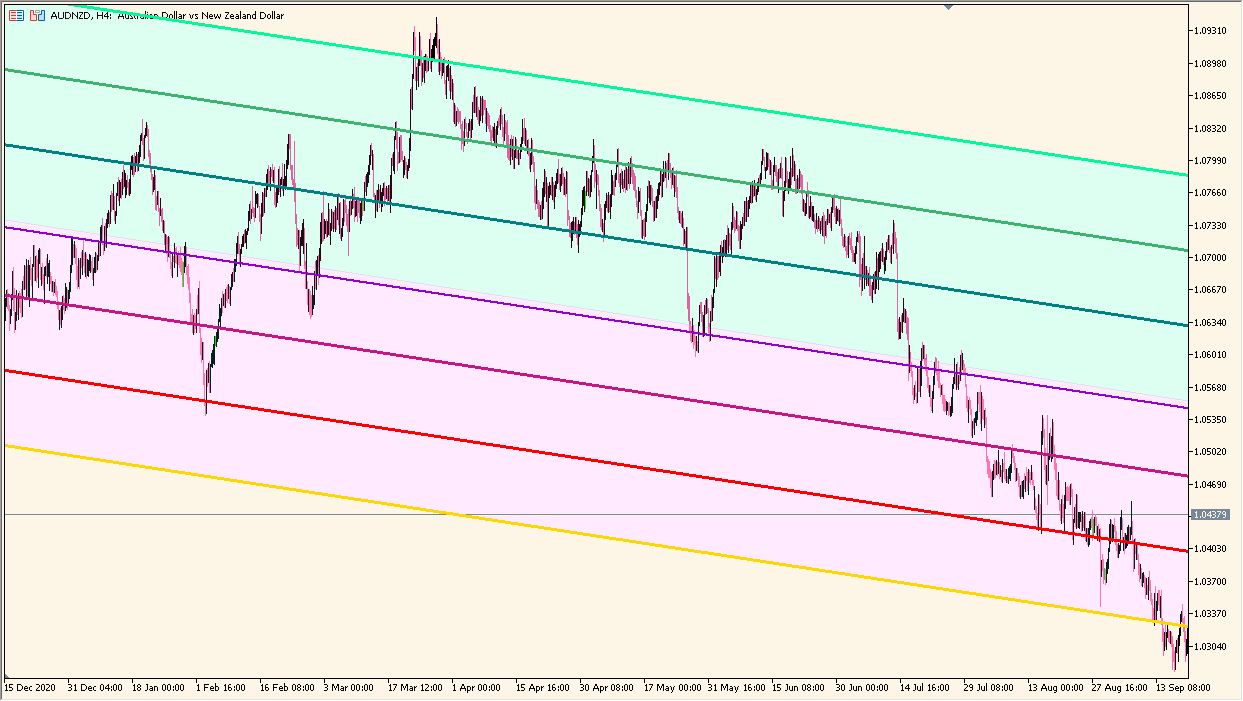

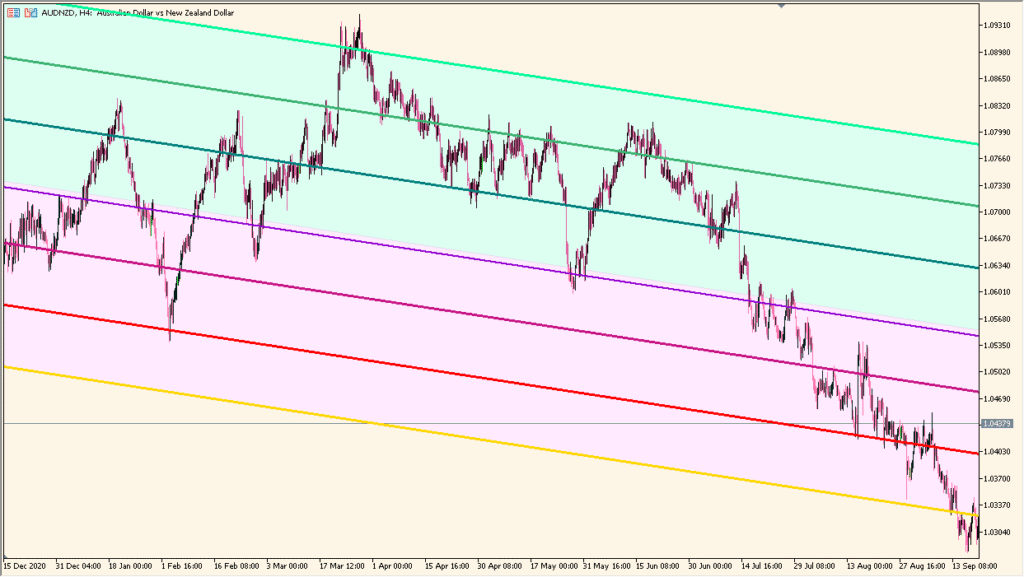

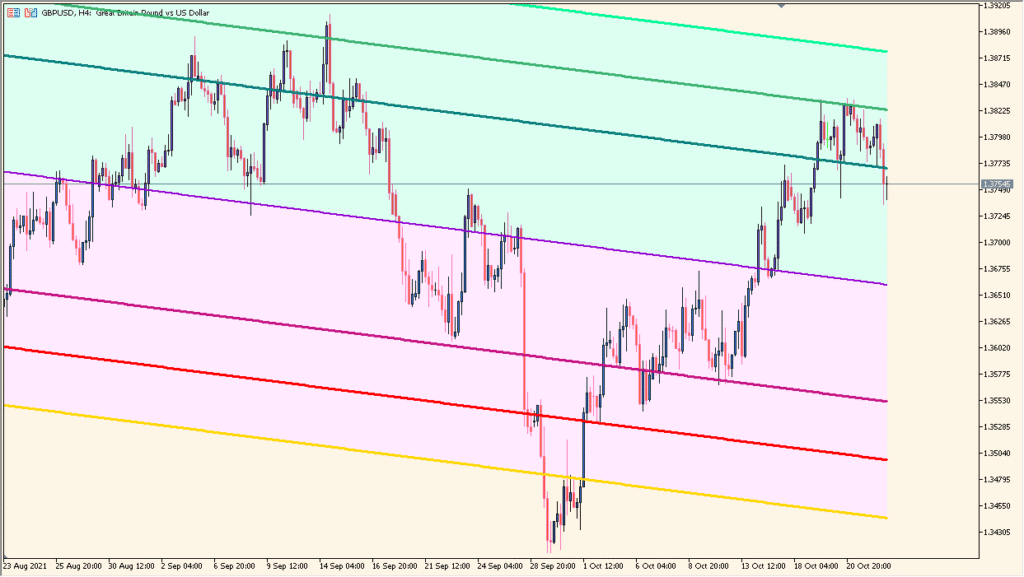

The Standard Deviation Channels x3 Cloud indicator for MT4 creates three dynamic deviation channels based on price volatility. These channels are drawn above and below a central mean line, helping traders visualize overbought and oversold areas, as well as potential trend boundaries. The colored background (“cloud”) makes it easy to recognize price zones at a glance.

This indicator is particularly useful for traders who focus on price deviations from the mean or those using standard deviation as part of their volatility-based strategy. It provides a clear visual framework for identifying price extremes and range conditions.

How to Use It in Practice

In practical trading, you can use the Standard Deviation Channels x3 Cloud indicator to:

- Identify when the price is deviating too far from its average, signaling potential reversals or retracements.

- Detect volatility expansion and contraction based on channel width changes.

- Use the upper and lower channels as dynamic support and resistance levels.

- Combine with momentum indicators to confirm entry or exit points around the channel edges.

When the price consistently stays within the upper channels, it may indicate a strong uptrend, while movement around the lower channels suggests a downtrend. Sudden touches beyond the outermost deviation bands often hint at short-term exhaustion or correction opportunities.

Parameter Explanations

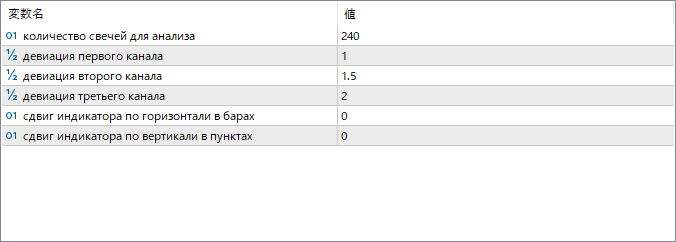

количество свечей для анализа

Specifies the number of candles used for the calculation. A larger value produces smoother channels, while a smaller one makes them more responsive to recent price changes.

девиация первого канала

Defines the standard deviation multiplier for the first (inner) channel. This channel represents minor deviations from the mean.

девиация второго канала

Sets the multiplier for the second (middle) channel. This level captures medium deviations and is often used as a moderate volatility boundary.

девиация третьего канала

Defines the multiplier for the third (outermost) channel. It highlights strong volatility extremes and possible overbought/oversold conditions.

сдвиг индикатора по горизонтали в барах

Moves the entire channel structure horizontally on the chart by the specified number of bars. This can be used for forward or backward projection.

сдвиг индикатора по вертикали в пунктах

Adjusts the channel position vertically in points, useful for fine-tuning alignment or avoiding overlap with other indicators.