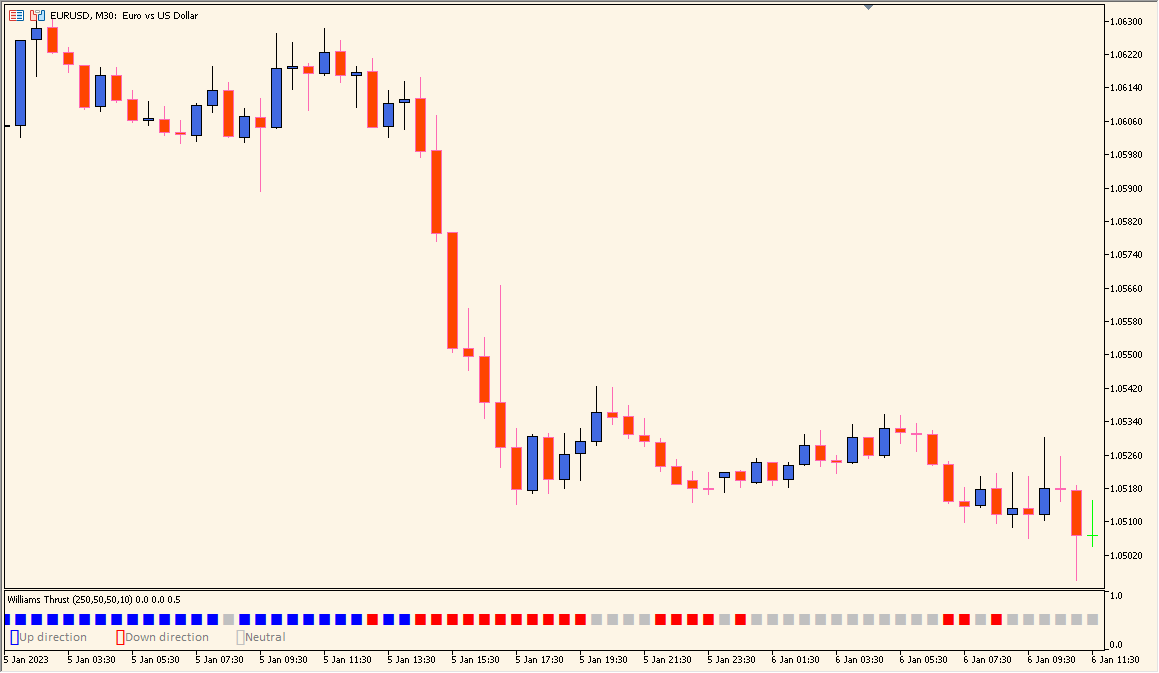

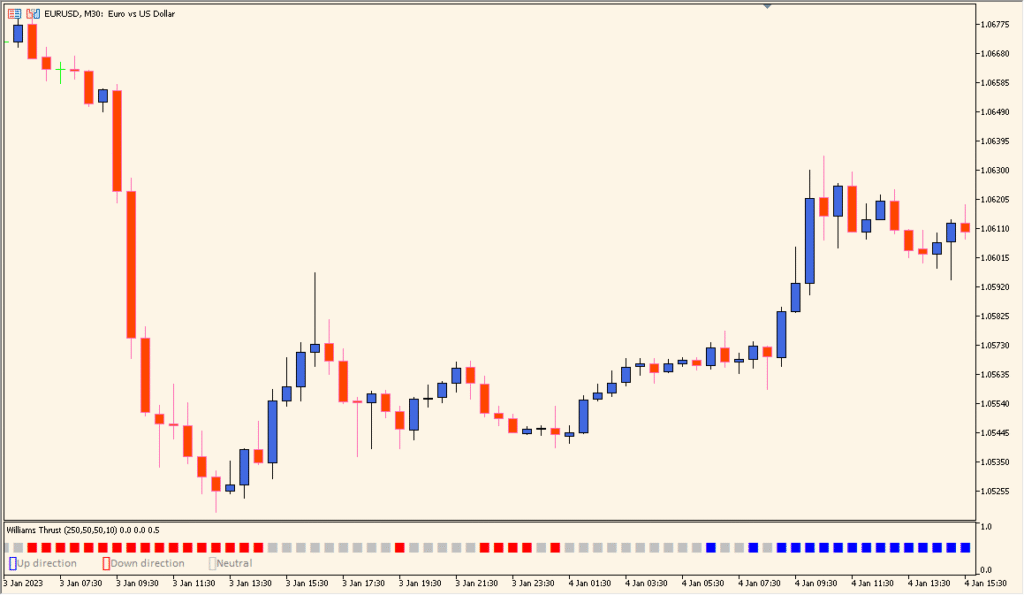

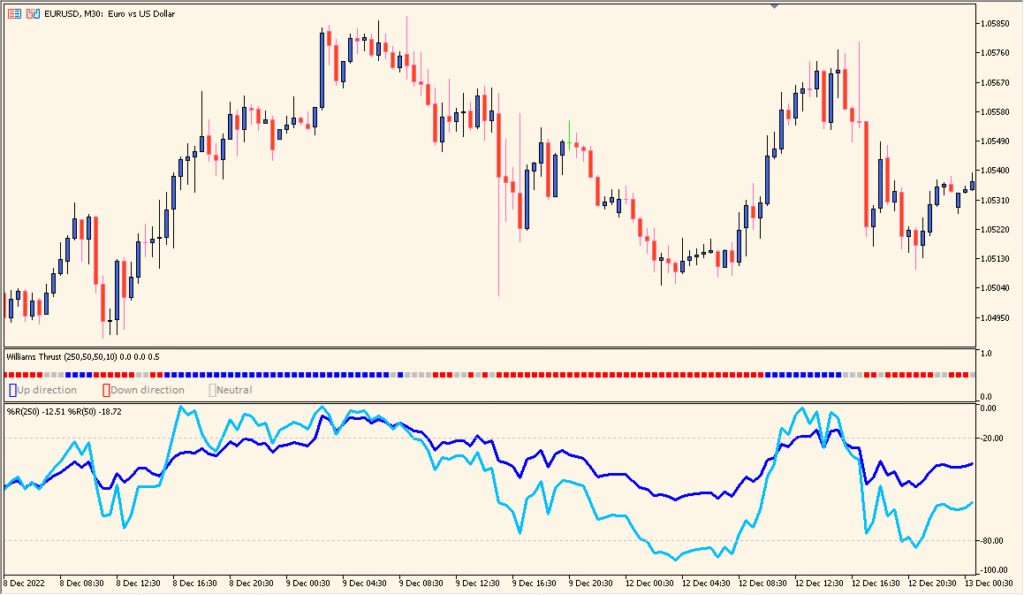

Overview of the Williams Thrust Indicator

The Williams Thrust indicator for MT4 combines two Williams %R calculations with moving averages to detect synchronized momentum thrusts. It helps traders identify when short-term and long-term momentum align, signaling strong potential continuation or reversal moves. The indicator smooths %R values using exponential moving averages to reduce noise and highlight clear momentum phases.

By tracking both fast and slow %R components, it provides an objective way to visualize the strength and consistency of price acceleration, useful for momentum traders who rely on timing thrust entries and exits.

How to Use It in Practice

In live trading, the Williams Thrust indicator can be applied in several ways:

- Identify synchronized bullish or bearish thrusts when both %R lines move in the same direction.

- Spot early momentum alignment that precedes trend acceleration or reversal.

- Filter trade entries to match the dominant momentum direction.

- Use as a confirmation tool alongside trend or breakout strategies.

When both %R lines and their moving averages agree, it indicates momentum agreement across timeframes, increasing the probability of a strong directional thrust.

Parameter Explanations

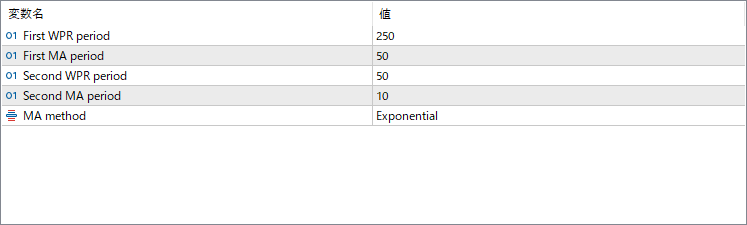

First WPR period

Defines the longer lookback period for the main Williams %R calculation. It captures the broader momentum structure of the market.

First MA period

Sets the smoothing period for the first Williams %R line using a moving average to reduce short-term fluctuations.

Second WPR period

Specifies the shorter lookback for a faster %R calculation that reacts quickly to recent price movements.

Second MA period

Defines the smoothing level for the faster %R line to balance responsiveness with signal clarity.

MA method

Chooses the moving average type used for smoothing (%R values), such as Exponential, Simple, or others available in MT4.